Emerging Europe

boasts lowest taxes & labor costs

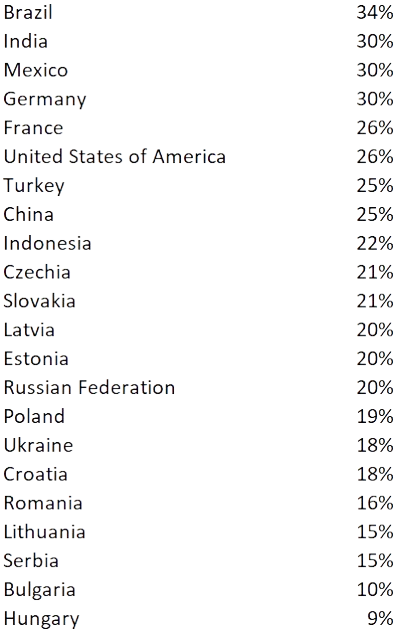

Corporate tax rates

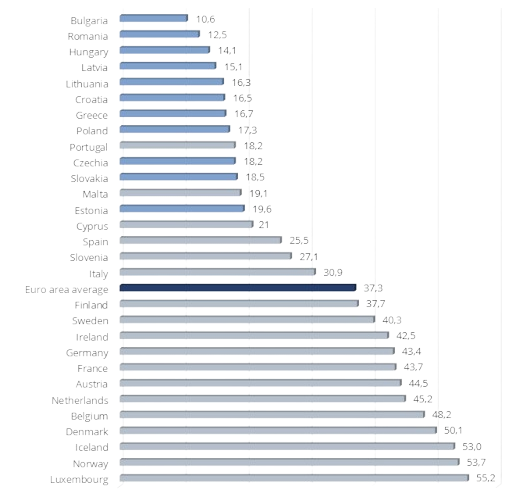

Labor cost per hour ( E ), 2017

Taxes much lower in CEE vs. developed world

States provide tax incentives & additional stimulus to attract foreign investors

While convergence has been driving income growth, wages are still far below European averages

Min wages range b/n €551 and €707 eur in Bulgaria and Hungary vs €2 161 and €2 193 eur for Germany and The Netherlands.